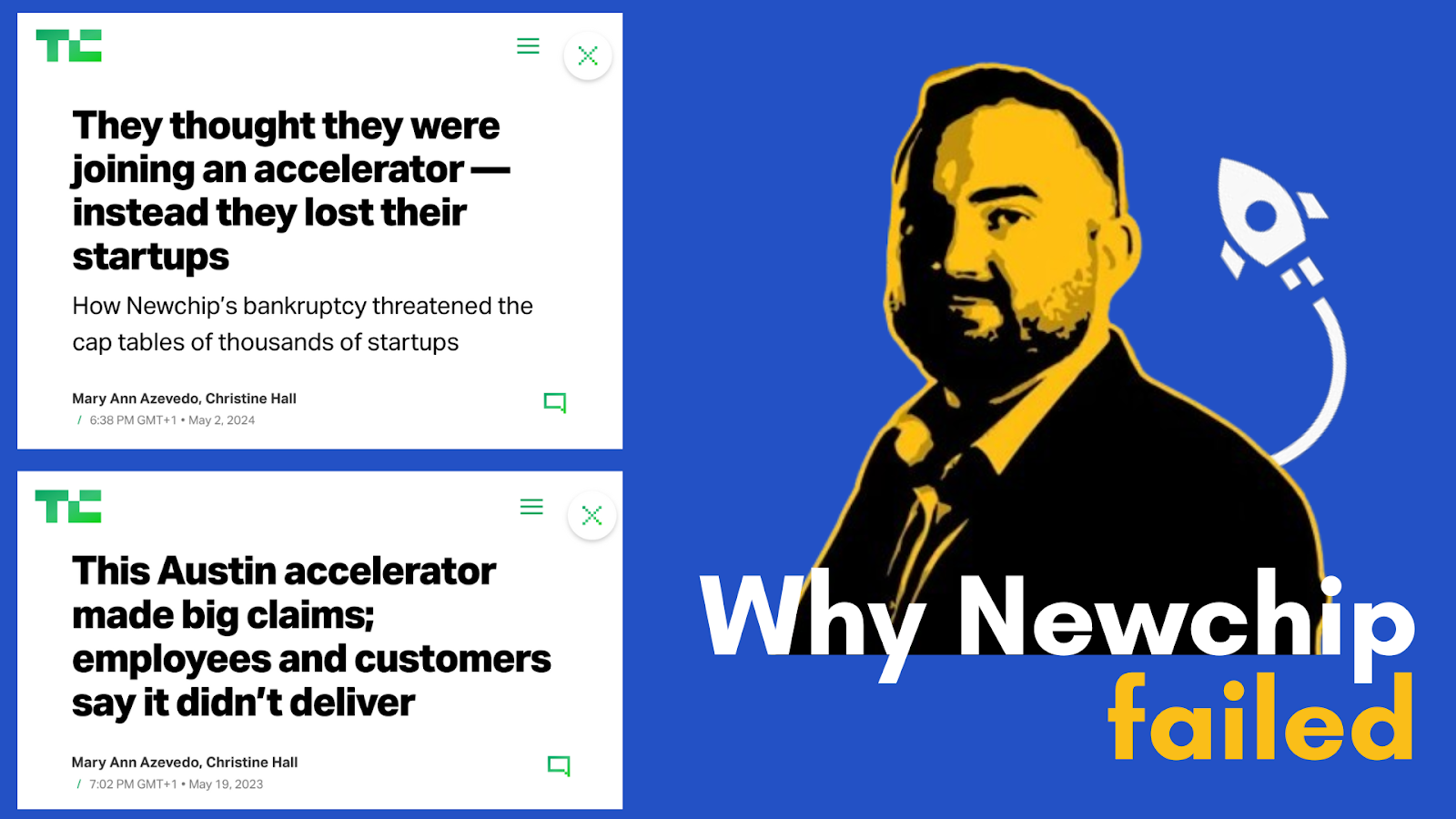

Why Newchip Failed: A Lesson for Founders

Newchip was a fee-based accelerator that promised to teach entrepreneurs “all of the skills and tools necessary to build, scale, and fund their startups.”

They filed for bankruptcy in May 2023 – and for the startups involved with them, things only got worse from there.

What is a (good) accelerator?

Let’s start with a definition from Silicon Valley Bank: “A startup accelerator is a mentor-based program that provides guidance, support, and limited funding in exchange for equity.” But what does it look like in practice?

There are over 200 accelerators in the US alone, often investor-funded but sometimes backed by corporations or universities, like Stanford’s StartX. For a few months, successful candidates will benefit from their accelerator’s guidance and network of connections to speed up growth while using the financial investment to build and cover early business expenses. All this is amping up to Demo Day, an event where candidates demo their products to investors to begin the next phase of their startup journey.

The gold standard of accelerators is Y Combinator. YC is an intense and highly selective bi-annual 3-month program that’s mentored companies like Reddit, Airbnb, Stripe, and Doordash. Over 5% become unicorns — aka companies valued at over $1 billion — an unrivaled success rate.

What is Newchip?

Newchip itself started life in an accelerator, Austin-based Sputnik ATX. Originally a “kayak of funding,” a marketplace showcasing deals from various equity-based crowdfunding platforms, Newchip later pivoted to an accelerator model, offering a 3-month program at a price tag of $3,000 to $20,000.

Today, Newchip has an F rating with the Better Business Bureau and is in the middle of a court-ordered liquidation, auctioning off all of its assets to repay creditors including Apex Funding Source and the U.S. Small Business Administration. But where did things go wrong for Newchip? And for the startups that were taken in by the accelerator’s big claims, what happens now?

The Fee

A fee-based model isn’t necessarily the problem; the price tag is.

For the record, most accelerators, Y Combinator included, are equity-based rather than fee-based. That ties the monetary return on their investment directly to the success of the startups they work with — basically, they only make money if you do.

Not all fee-based programs are necessarily scams, but the sky-high price tag of Newchip was a red flag — especially when it’s being asked of founders at the very beginning of their startup journey.

Newchip even had costly “add-ons” such as the opportunity to pitch to investors, a mainstay of accelerator programs. One founder, Angela DiMarco, paid to give a 3-minute elevator pitch of her company to investors — an event that never took place.

Many participants said the price of the accelerator course was far too high for the quality of services provided. “I did the program for less than a week and a half, and I realized I was duped,” founder John Laine said in an interview. “It’s the crappiest version of online education you can produce.”

Some have also sought a partial or full refund on the grounds of ‘services not rendered.’

Lacey Hunter, a founder who’s been through the Newchip program, now offers this advice to other founders considering the accelerator path:

Refund Policy

On the topic of refunds — Newchip made it almost impossible for dissatisfied founders to claim a refund of any sort on the accelerator program.

Former employees said the company “rarely issued refunds.” This tracks with customers’ experiences: founder Orri Bogdan said he was promised a full refund if he failed to raise funding through Newchip, but that the company then “snuck in extreme stipulations with the intention of never refunding anyone.”

This led to several instances of founders blackmailing Newchip with bad reviews until refunds were issued.

The Quality

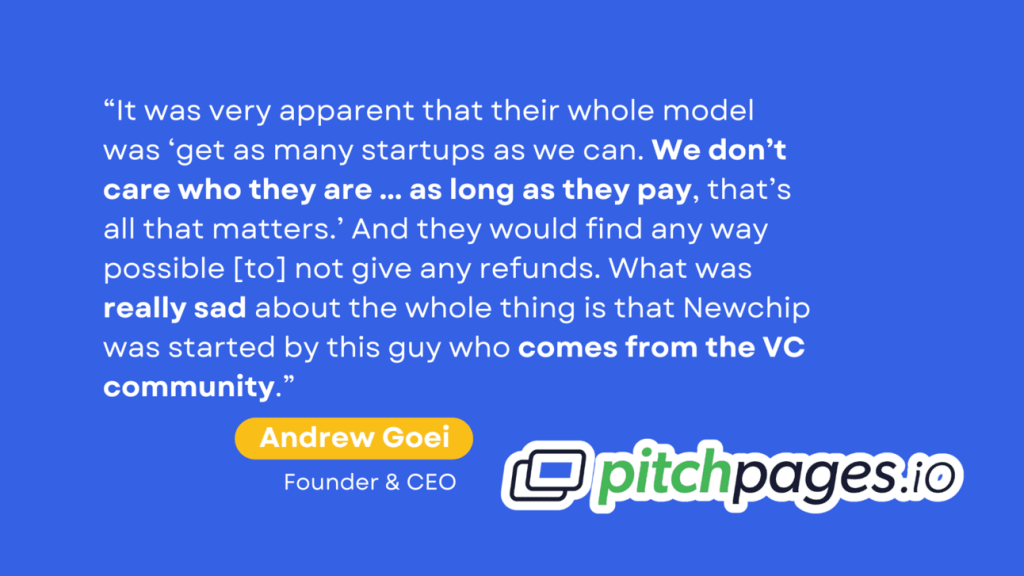

The price tag could have been validated by a world-class experience. Unfortunately, that’s not what founders received.

Australia-based founder Jari Kemppinen describes how the accelerator “lacked one-to-one communication, and I was left alone to navigate an enormous amount of content without any help.”

Another founder, Ahmed Zobi, also experienced a shocking lack of support. He says that his assigned mentor “ghosted” him, after suddenly announcing he was traveling to London. Zobi never heard from him again, despite requesting advice and further meetings.

Others report that they never received the $100,000 investment they were promised by Newchip.

Mismanagement & the “Military Mindset”

Meet CEO Andrew Ryan.

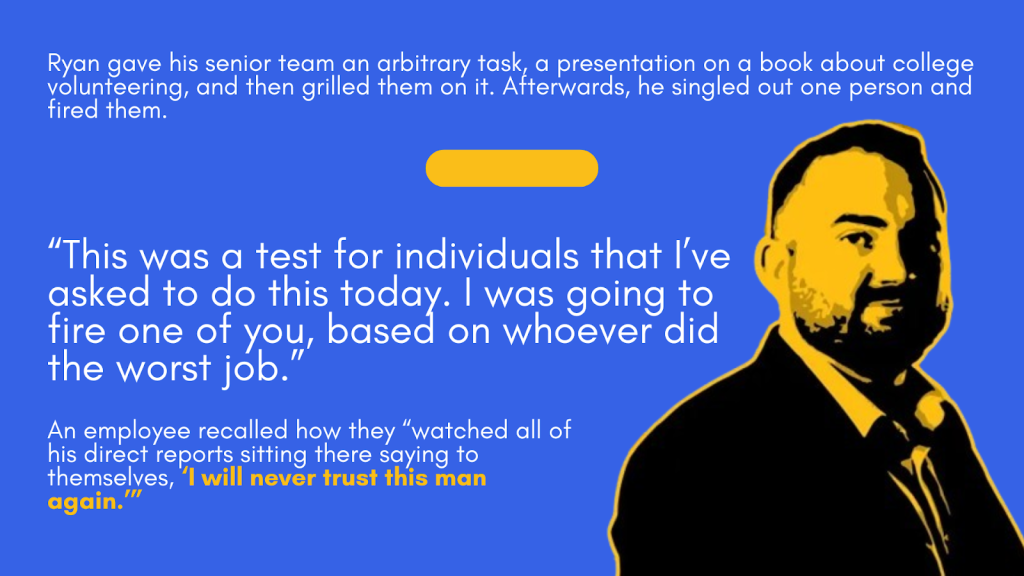

The founder, who formerly went by Ryan Rafols, has faced a host of complaints from former employees over everything from the way he ran Newchip to his interpersonal relations.

He’s been described as “degrading and demeaning … saying things like ‘I’m too good to be wasting my brilliance on this’ and just scream[ing] at people.”

Even Ryan admits he “might have come across as demeaning.”

Employees even staged a walkout over “lack of leadership and mismanagement.” Their claims are shocking: that Newchip took back sales commissions on multiple occasions, and that Ryan gave himself bonuses during periods of financial deficit.

Ryan himself recalls that employees had requested “a new CEO” — and though he denies it, sources say he asked early investor Joe Merrill to replace him as CEO before backtracking and rescinding the offer. If he had been willing to step down, he may even have been able to avoid going into Chapter 7 bankruptcy, according to interim CFO Kerstin Hadzik — the judge was “offering a lifeline” of replacing him with a chief restructuring officer and Ryan rejected it.

Ownership

Since bankruptcy, the court has ordered Newchip to auction off the warrants it holds in over 1,000 startups that went through the accelerator. Many have already been auctioned off — and some founders, like Lacey Hunter of TechAid, have lost their companies as a result.

Warrants are the rights to buy an ownership stake in a company, something that many founders had given to Newchip as part of the accelerator program. Hunter tried to buy back the warrants to TechAid herself but was rejected, forcing her to close the company.

If there is money left over from the sale of these warrants, it will be distributed to shareholders. Ryan is the majority shareholder.

The Takeaway

Transparency is the biggest lesson here. Whatever Newchip’s intentions were, they left a lot of founders underwhelmed and underserved — and that’s before the liquidation and warrants auctions.

Being upfront about everything from services provided to the purpose of tasks given to employees would have built a culture of trust and open communication throughout the organization and improved customer satisfaction.

It’s also a poignant reminder of the importance of putting the customer first, always.

Okay 23win8bet, let’s give this a shot. The site looks pretty modern. Registration was simple, and I was able to get started quickly browsing around. So far, so good! I’ll keep you guys posted. Try it yourself: 23win8bet

It’s great to see platforms prioritizing a secure & fair experience! Responsible gaming is key, and streamlined registration (like at ph 799 legit) can help. Enjoy the games, but always play within your limits! 😊

For real, sicbogames is kinda something else. A lot of variety, so I’m not bored playing the same game everyday. Check this out now sicbogames

Gonna give b77betgame a try tonight. Feels like a lucky night! Hope I hit the jackpot! b77betgame