Destiny Tech, forward contracts and the secondary market – explained.

The market for private company stocks, aka the secondary market, is on track to hit $64 billion this year, up 40% from last year. The growth is partly due to the reluctance of many startups to go public, like SpaceX, OpenAI and Stripe.

But are these sales legit?

History

The secondary market has always been “like the Wild West.”

Before Facebook went public, its privately held shares frequently changed hands on marketplaces such as SharesPost. The SEC tried to put a stop to it, and fined SharesPost $80k. But the secondary market has only grown from there.

Forward contracts

As startups tried to restrict sales of their stock, forward contracts became popular, paying startup employees cash to transfer shares to an investor in the future.

When Airbnb went public, at least $475m in shares was transferred from employees to investors.

Destiny

Kelly, CEO of Forge (which pioneered forward contracts) says, “the market has never been more accepting of secondary liquidity.”

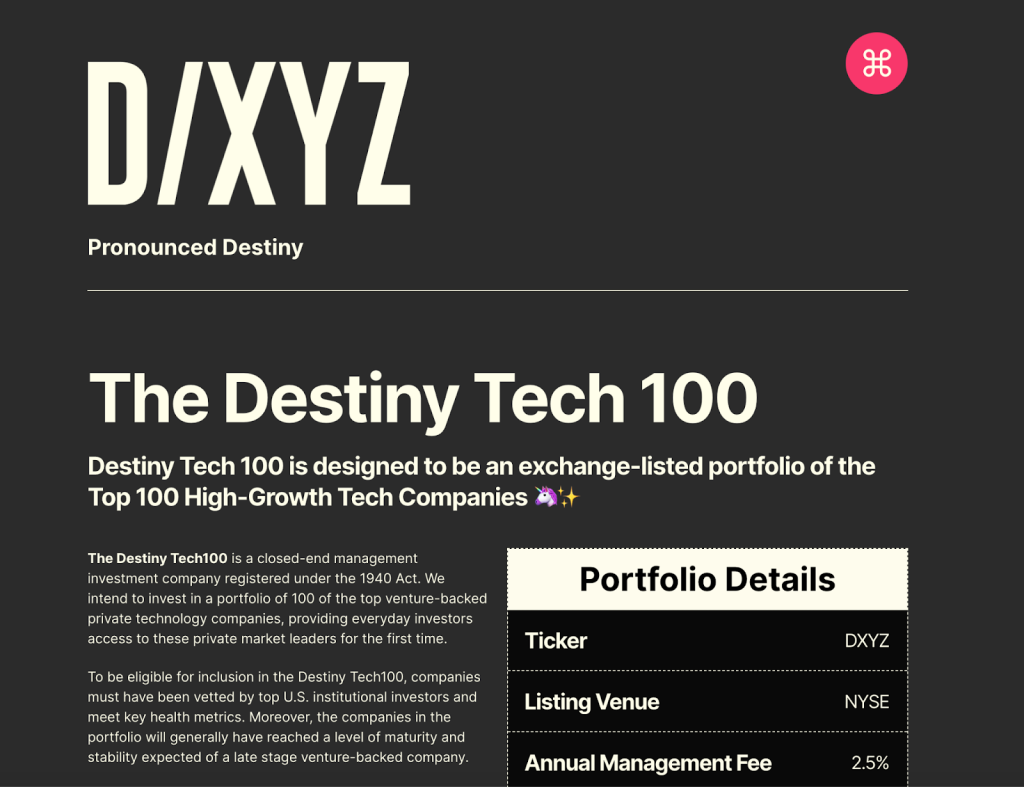

Forge cofounder Sohail Prasad left in 2019 to start Destiny Tech100, a fund that owns shares in private tech startups like Stripe and SpaceX

Destiny lets regular people invest in private startups. But the legitimacy of this practice is questionable Stripe said the fund did not actually own their shares. Robinhood stopped letting investors buy into the fund, calling its listing on their site a clerical error. A competitor called Destiny “too good to be true”

The competition

Destiny isn’t the only one in this space. Augment Marketplace offers Discord, Flexport, Airtable and Ramp through “sell orders,” connecting investors to people trying to sell these shares. Hiive is currently offering shares in AI startup Anthropic.

And it’s not just new players getting in on the secondary market. Investment funds like Stack Capital, Fundrise and ARK Venture Fund are offering private shares, too. Stack Capital, for example, offers access to companies like SpaceX and Canva.

Pushback

Companies aren’t thrilled by the rise of the secondary market. Stripe warned that any offer to invest in them coming from outside the company is “very likely a scam” + “may have no value at all.”

Fintech startup Plaid said it “does not recognize shares acquired in this manner”

The future

Prasad’s goal at Destiny is “to drive a world where it becomes less binary from being private to being public.”

Recently, Destiny’s share price has soared, hitting a market cap of over $1bn, though last week it crashed to a market cap of $141m.

But interest in the secondary market isn’t receding. As the most influential startups put off going public for longer, people want a piece of the action. Expect more funds like Destiny and plenty more secondary market deals moving forward.

Just checking out rumislotsgame – thinking about spinning some virtual reels later. Anybody had any luck there? Gotta love a good slots session! Get spinning with rumislotsgame!

Fabetvina, folks! This one’s a new one for me. It seems focused on Vietnamese players… So if you’re in that area, it might be worth digging a little deeper to see what they’re offering. Check it out first: fabetvina

777tiger6… Yeah, I’ve seen that one around. The site’s okay, nothing too fancy, but it does the job. Got a few wins, lost a few too. Just be smart and don’t go chasing your losses, alright? Give it a whirl here: 777tiger6